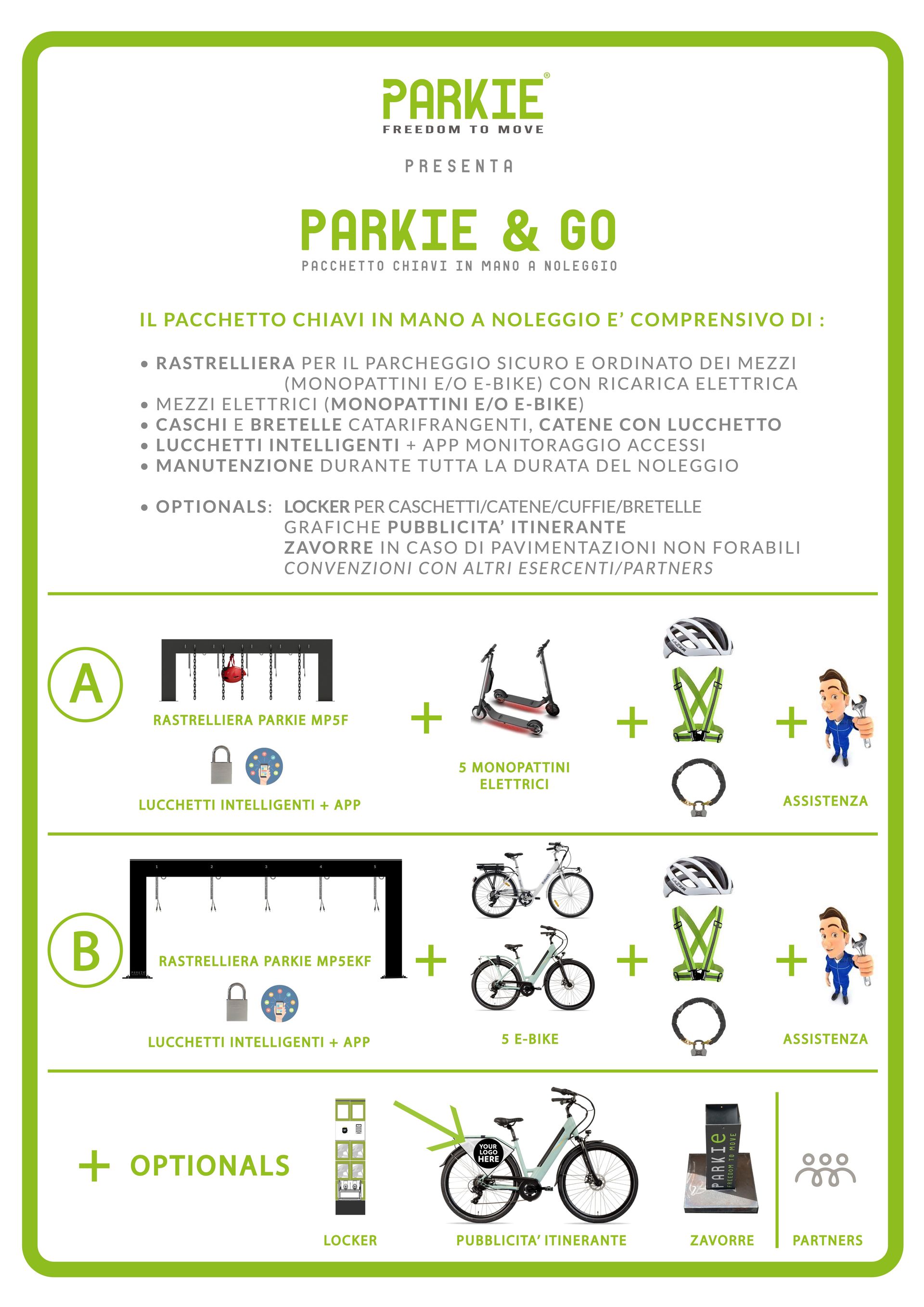

THE PARKIE & GO SERVICE HAS BEEN DESIGNED TO NOT DISTURB THE NORMAL OPERATIONS OF THE HOTEL RECEPTION, THE GUEST IS ABLE TO MANAGE THEMSELVES COMPLETELY, FOLLOWING THE INDICATIONS PROVIDED AT THE RECEPTION AND THROUGH THE INFORMATION BROCHURE, HE CAN BE INDEPENDENT ALSO FOR PAYMENTS. YOU CAN CHOOSE DIFFERENT SOLUTIONS, see cases A and B with or without lockers for e-bikes or scooters (e-scooters) below.

With Parkie you can choose whether to BUY or acquire the goods with operational RENTAL. Rental is particularly suitable for HOTELS, CAMPSITE, and for all those facilities that prefer to have the equipment without having to purchase it. With the PARKIE & GO formula, the customer can acquire with rental not only the Parkie racks but also the vehicles (electric scooters and/or e-bikes) and accessories (helmets, reflective braces, etc.), a real key package in your hand without worries!

Thanks to the system designed by Parkie, the reception operator does not need to move from his station because it is the guest/customer who independently completes the various procedures.

RENTAL is a medium and long-term operation suitable for all customers who need to use equipment without having to purchase it.

It is a formula that allows you to follow technological innovation in a simpler way and to always stay up to date based on actual business needs, eliminating all fiscal, accounting and legal problems.

Rental combines the benefit of payment deferred over time, giving the Customer the opportunity to adapt the equipment according to his needs, it also guarantees shortened depreciation of the goods, no risk of obsolescence for him and obviously more precise cost planning corporate.

If the Customer PURCHASES the goods directly:

- Must execute the depreciation plan envisaged for the capital goods for the entirety of the invoice issued and must include the asset in the company assets (costs). Commits economically with a direct and immediate cash outflow, drawing on personal or company finances, or with a classic loan, for which he bears the expenses and interest. The purchase is reported in the sector studies and can have a decisive influence on the calculation of the tax rates and mark-up coefficients.

If the Customer acquires the goods through a RENTAL contract:

- It must not depreciate absolutely anything and must not include anything in company assets (the asset is the property of the leasing company), therefore it does not fall within the Sector Studies, strongly affecting the possibility of being adequate and coherent. It can deduct all the monthly or quarterly installments (VAT included), including the first which is normally not possible in leasing. It has a tax advantage: the installments are fully deductible in a period which may be shorter than the minimum fiscal period foreseen by the Financial Lease (Leasing) It is protected and guaranteed regarding the correct functioning of the goods, since maintenance is managed by our company which intervenes on-site for the entire period of the contract.

RENTAL is a simplified and innovative management formula that allows you to use goods without ownership.

At the end of the contract the Customer has the right to decide whether or not to purchase the asset, at a minimum cost, therefore if he purchases the asset, it will be entered in the asset register with a strong reduction in the tax cost, or decide to rent a new asset instrumental, with the aim of avoiding technological obsolescence.

CASES:

A: E-BIKE NO LOCKER, E-SCOOTER NO LOCKER

B: E-BIKE CON LOCKER, E-SCOOTER CON LOCKER